The crypto market moves in cycles, and history has shown that every bear market is followed by an explosive bull run. The next crypto bull run is right around the corner, and those who position themselves wisely stand to make life changing gains. But here’s the secret most traders miss. Whales control the market! If you can track their moves, you can ride the wave before the masses even realize what’s happening.

This is where the Crypto Whale Tracker strategy comes in a powerful tool that can help you flip upto $100K by following the biggest players in crypto. In this article, we’ll break down why the next crypto bull run is near, how whale tracking works, and how you can use this insider knowledge to maximize your gains.

Table of Contents

Understanding the Crypto Market Cycles: Why Bull Runs Happen

To take full advantage of the next crypto bull run, it’s crucial to understand why and how these cycles occur. Crypto markets don’t move randomly, each bull run follows a pattern driven by key factors:

1. Bitcoin Halving and Its Impact

Historically, every Bitcoin halving event (which happens roughly every four years) has been a major trigger for a bull run. Why? Because halving reduces the supply of new BTC entering the market, creating scarcity and driving up demand. This often sets the stage for a massive price surge across the entire crypto market.

2. Institutional and Retail Adoption

When large financial institutions, hedge funds, and corporations start investing heavily in crypto, it signals legitimacy to the market. Combine that with FOMO driven retail investors rushing in, and prices start skyrocketing.

3. The Power of Crypto Whales

Whales or entities holding massive amounts of crypto have the ability to manipulate prices and set market trends. Tracking their movements can give you an edge in predicting market shifts before they happen.

The Whale Tracker Crypto Hack: How Big Players Control the Market

Ever wondered why some traders always seem to buy the right coins before a massive pump? It’s not luck, it’s strategy. And it all comes down to tracking crypto whales.

Who Are Crypto Whales?

Crypto whales are the big-money players in the market, think venture capitalists, hedge funds, and early Bitcoin adopters sitting on millions or even billions of dollars in crypto. When these whales buy or sell, they create massive price swings, sparking bull runs or crashes.

How to See What Crypto Whales Are Buying

The key to front-running the next crypto bull run is knowing where the whales are putting their money. If you can track their moves, you can ride their waves instead of getting crushed by them.

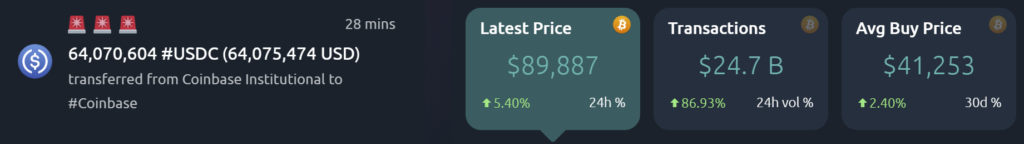

- Use Crypto Whale Trackers: Tools like Whale Alert, Arkham Intelligence, and Nansen track large transactions across blockchains.

- Follow On-Chain Data: Etherscan and BSCScan show real-time whale wallet movements.

- Monitor Exchange Wallets: Watch for sudden inflows or outflows on major exchanges like Binance and Coinbase.

- Social Media Signals: Some whales tease their moves on Twitter or in private Discord groups.

Why Whales Are Accumulating Before the Bull Run!

Right now, whale wallets are loading up on altcoins while the market is still quiet. This is a strong signal that the next crypto bull run is around the corner. But instead of panicking when the market is already hot, smart traders track whales early to get in before the explosion.

The $100 to $100K Strategy: Riding the Whale Waves Like a Pro

Tracking crypto whales is only half the game, the real magic happens when you act on their moves strategically. Here’s how you can flip $100 into $100K by leveraging whale activity before the next crypto bull run explodes.

Identify Accumulation Phases

When whales start buying a particular coin, they don’t do it all at once. Instead, they accumulate over time to avoid pumping the price too soon. This is your window to get in before the market notices.

How to spot accumulation:

- Whale wallets repeatedly buying the same token in small chunks

- Exchange outflows increasing for a specific coin

- Low price volatility despite high volume transactions

Buy Before the FOMO Kicks In

Once you’ve identified a coin that whales are accumulating, don’t wait for the headlines. By the time influencers and news outlets start hyping it, the whales will already be cashing out.

- Set limit orders at support levels instead of market buying

- DCA (Dollar-Cost Average) into your position to reduce risk

- Prioritize altcoins with strong fundamentals and whale interest

Watch for Pump Signals

When whales have finished accumulating, they often trigger the pump by creating a sudden surge in volume. creates FOMO, driving the price higher.

- A whale makes a large buy after weeks of accumulation

- Social media hype starts building around the coin

- Big wallet transactions move funds to exchanges

Take Profits Like a Whale

Retail traders often hold too long, hoping for 1000x gains. Whales, on the other hand, exit strategically, and that’s how they always win.

Pro exit strategies:

- Sell in increments: Take the profits at 2x, 5x, 10x, etc.

- Monitor whale selling activity: If the whales start offloading, don’t be the last one holding.

- Secure your gains: Convert profits into stablecoins or blue-chip cryptos like Bitcoin and Ethereum.

The next crypto bull run is shaping up to be one of the biggest in history. Will you be chasing pumps like retail traders, or front-running them like a whale? The choice is yours.

The Secret Whale Tactics to Multiply Profits While Others FOMO

Imagine this, Bitcoin starts pumping, social media is flooded with “we’re going to the moon” posts, and retail traders are scrambling to buy before it’s “too late.” But while the masses rush in, whales are already planning their exit.

That’s the reality of the crypto market. Big players don’t follow hype, they manufacture it. They accumulate before anyone notices, manipulate liquidity to their advantage, and then sell into retail excitement, walking away with massive profits while others are left holding the bags. So, how exactly do they do it? And more importantly, how can you spot these moves before they happen? Let’s break down the whale tactics that actually work.

Whales Buy When You’re Afraid, Not When You’re Excited

The secret to winning in the next crypto bull run isn’t buying when the charts are green, it’s accumulating when the market is in fear. Whales have zero emotions when it comes to their entries. When everyone else is panic-selling, they step in quietly, buying up assets at bargain prices.

They use Crypto Whale Trackers to monitor large sell-offs and wait for retail traders to dump their holdings in fear. A sudden drop? That’s an opportunity. A major news FUD event? Even better. While the average trader reacts emotionally, whales stick to data and market cycles.

The Fake Sell Off Trick: How Whales Manipulate Prices

Have you ever seen a coin about to break out, only for it to suddenly crash out of nowhere? That’s not random that’s market manipulation in action.

Whales will often place huge sell walls to make it look like there’s overwhelming selling pressure. Retail traders panic, thinking a dump is coming, and start selling their positions. But just before the market collapses, the whale removes the sell orders and buys up even more tokens at a discount.

This is why blindly following price action can be dangerous. If you’re not tracking on-chain whale movements, you’re only seeing half the picture.

How to See What Crypto Whales Are Buying? Before It’s Too Late!

Most people think whale moves are invisible, but that’s not true. Everything is on the blockchain, you just need the right tools to track it. Smart traders use whale tracker crypto tools to monitor large wallet movements in real time. If a certain token suddenly sees massive accumulation from wallets that previously bought early in the last bull run, it’s a strong indicator that something big is coming.

Whales don’t buy randomly. They move before the news hits. They position themselves before the hype wave starts. And they cash out while everyone else is just getting in.

By tracking their wallets, you can front-run their moves instead of getting left behind.

The Whale Signals Are Flashing: Position Yourself Before It’s Too Late

The biggest mistake retail traders make? Ignoring the signs right in front of them. Crypto whales don’t just trade, they move markets. When their signals start flashing, it’s not random noise. It’s a blueprint for what’s about to happen next. When large sums start pouring into specific altcoins or Bitcoin at a rapid pace, it’s not a coincidence. Platforms like crypto whale trackers reveal these massive transactions in real time. If the whales are accumulating, ask yourself why, they’re not here to lose money.

Final Thoughts: Will You Follow the Whales or Get Left Behind?

The next crypto bull run isn’t just about buying and hoping for the best. It’s about strategy, discipline, and reading the signals that most people ignore. The whales already have their game plan, do you? Because in the end, there are only two types of traders: those who ride the wave early and those who chase it too late.